Ever heard someone say “ETH is too expensive, just use Arbitrum”? Or “Solana is faster than Ethereum because it’s Layer 1”? If you’ve ever been confused about what Layer 1, Layer 2, and now even Layer 3 mean — you’re not alone. Most people ape into ecosystems without understanding how these layers stack. Let’s simplify it degen-style so you know what chain you’re actually playing on.

Layer 1 (L1): The Base Blockchains

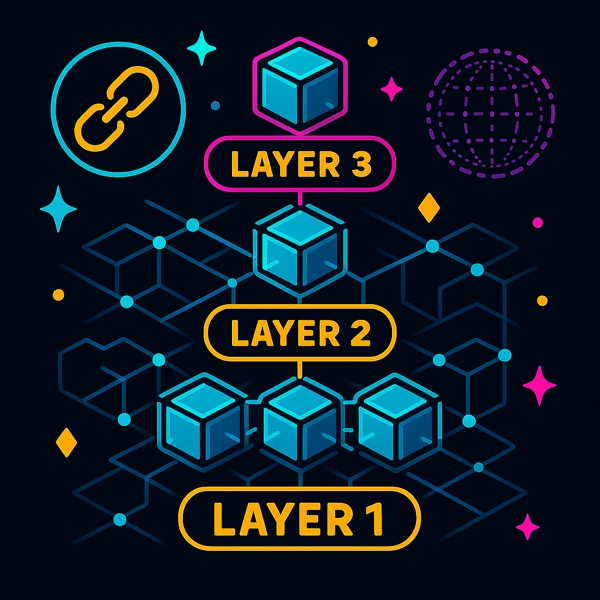

Layer 1 = the foundation. These are the blockchains that process and secure transactions directly.

Examples:

- Bitcoin (BTC): The OG store of value. Great for security, not for DeFi.

- Ethereum (ETH): Smart contract pioneer, runs most DeFi/NFTs.

- Solana (SOL): Fast, cheap, and became the meme casino of 2024.

- BNB Chain, Avalanche, Sui, Aptos: Competing ecosystems with their own validators.

Pros of L1s:

- Security and decentralization are strongest here.

- Native coins often become blue-chips.

- Can run their own dApps directly.

Cons of L1s:

- Can be slow and expensive (ETH gas wars anyone?).

- Scaling is limited without help.

Layer 2 (L2): Scaling Solutions

Layer 2s are built on top of L1s to make them faster and cheaper. They batch transactions and settle them back on the L1 for security.

Examples:

- Arbitrum & Optimism (ETH rollups): Cut ETH fees from $20 to under $1.

- Base (Coinbase’s L2): Built on Optimism tech, big for memes.

- zkSync & StarkNet: Zero-knowledge rollups pushing efficiency.

- Lightning Network (Bitcoin): Instant, near-free BTC payments.

Pros of L2s:

- Much cheaper fees.

- Faster confirmation.

- Same security as the parent L1.

Cons of L2s:

- More complex (bridging in/out).

- Still evolving tech — bugs happen.

- Not as decentralized as the main chain yet.

Layer 3 (L3): The New Frontier

Layer 3s are like specialized highways on top of Layer 2s. Think of them as application-specific chains built for speed and custom use cases.

Examples:

- zkSync Hyperchains: Custom chains for dApps, still secured by Ethereum.

- StarkEx (used by dYdX): Scaling engine for order books and trading apps.

- Appchains: Gaming studios or DeFi platforms building their own L3s for unique needs.

Pros of L3s:

- Tailored to specific apps (gaming, DeFi, identity).

- Near-zero fees, super fast.

- Flexible design.

Cons of L3s:

- Very new and experimental.

- Fragmented liquidity (funds spread across many layers).

- Extra complexity for users.

Real-World Example

- Buying a $20 NFT on Ethereum mainnet might cost $15 gas.

- On Arbitrum (L2), the same NFT costs $0.20 gas.

- On a gaming-specific L3, the NFT trade is nearly free and instant.

This is why degens bridged en masse to Arbitrum, Optimism, and Base during meme seasons. Gas efficiency = more trades = more fun.

Why It Matters for Investors

- L1 coins (ETH, SOL, BNB) tend to be the safest bets.

- L2 tokens (ARB, OP, ZK, STRK) are growth plays with strong narratives.

- L3 projects could 50–100x if adoption comes, but they’re highest risk.

Final Thoughts: Stack the Layers, Stack Your Bags

Layers aren’t just jargon — they shape how crypto actually works. L1s give security, L2s give scaling, and L3s unlock custom use cases.

If you want to be smart with your portfolio: hold some blue-chip L1s, get exposure to L2 tokens riding the scaling wave, and sprinkle in a little degen money on L3 experiments.

That way, no matter where the future scales, you’re riding the right layer. Wagmi. 🚀